Do you know enough about your car insurance policy?

If you are an insured driver, you know that your car insurance policy will cover you if you are involved in an accident. Still, you may not fully understand how your car insurance policy works. Insurance policies are not all the same, but they do share some basic components. Not knowing the basics of your policy could lead you to purchase an inadequate policy or accept an unfair settlement in the event of an accident.

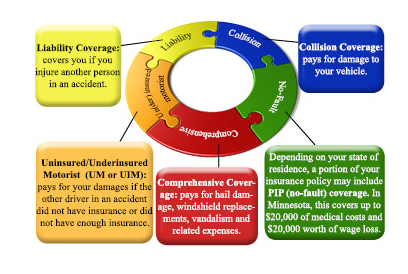

Imagine that your insurance policy is like a puzzle with five different pieces. Each piece of the puzzle is essentially a promise to pay when a certain event happens.

Liability Coverage: In all states, the at-fault driver is responsible for damages for pain, disability, disfigurement, loss of future earnings and emotional distress. If you do not have an adequate policy, you may be personally responsible for another’s injuries if the collision was your fault.

Uninsured/Underinsured Motorist (UM or UIM) Coverage: If an accident occurs with an uninsured, underinsured, or hit-and-run motorist who is determined to be legally at fault, this portion of your policy would cover you for all sums up to your policy limits. Uninsured Motorists Property Damage (UMPD) liability coverage pays for property damages caused by uninsured drivers.

Comprehensive Coverage: Comprehensive coverage pays for damage caused by weather conditions, vandalism, and other similar hazards.

Collision Coverage: Collision coverage pays for the damage to your vehicle if it is involved in a collision.

No-Fault: Some states, including Minnesota, are “no-fault” states. If you have no-fault insurance, your medical bills and wage loss are covered by your own insurance, regardless of fault. Although there are many legal variations of “no-fault,” most of them still allow people to sue the negligent (at-fault) party if their damages exceed their policy limits. If the at-fault driver does not have insurance or does not have enough, the uninsured motorist or under-insured motorist provisions may apply.

Some other terms you may find in your policy paperwork:

Declarations: This section of your policy contains individual facts about you, your vehicle, and your policy. It contains the type of coverage you have purchased, your policy limits, and your deductibles. It is important that the information in this section is accurate, or you could risk having a claim denied.

Coverage Parts/Insuring Agreement: This section goes over your coverage options and outlines the parts of your policy (described above).

Exclusions: This section identifies your policy’s limitations (in other words, what will not be covered).

Conditions: This section details procedures and responsibilities of both the policyholder and the insurance company.

Definitions: Basically, this section contains the “fine print” that clarifies the language used in the agreement.

From our experience handling car accidents and other types of automobile accidents for over 29 years, we have seen many unfortunate scenarios that have resulted from inadequate insurance policies.

Some tips we have shared with people in the past include:

1.) Insure yourself for the worst case scenario – something you could NOT afford.

2.) If you select the highest deductible that you can afford, your premiums will be lower.

3.) We recommend you have at least $100,000 liability coverage and uninsured/underinsured (UM & UIM) coverage.

It is important to remember that policies differ, and state laws regarding policies differ as well. If you have questions about the details in your car insurance policy contract, it is important to ask them before an event happens, not after.

If you or a loved one has been in a serious car accident, do not hesitate to call us for a free consultation.